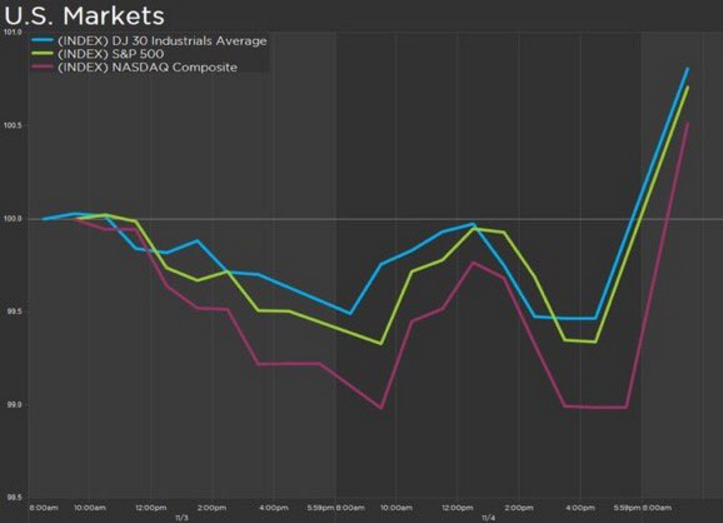

Overseas markets were up more than one percent and the Standard & Poor’s 500-stock index broke its longest slide in nearly 36 years on Monday as investors bet on a Hillary Clinton victory over Republican Donald Trump going into Tuesday’s election.

“This it the Comey celebration,” said Washington investor Michael Farr, referring to FBI Director James Comey’s letter to Congress on Sunday saying his agency’s investigation of Clinton’s emails was complete and there would be no prosecution.

Market volatility was high since the Oct. 28 announcement that the agency was looking into another batch of e-mails from Clinton’s server, which threw fresh uncertainty on the race for the presidency.

“The FBI gets out of the way and markets are seeing a clearer path for a Clinton victory, which is what markets have expected for some time,” said Farr, chief executive of Farr, Miller & Washington, a D.C. investment advisory firm.

Markets were up across the board, with the S&P 500 climbing 1.5 percent in early trading. The tech-heavy Nasdaq was up over 1.7 percent. Europe and Asia were up similar percentages.

Short-term turbulence surrounding elections is not indicative of the longer term, Bloomberg reported over the weekend.

“In the 22 elections going back to 1928, the S&P 500 has fallen 15 times the day after polls close, for an average loss of 1.8 percent. Stocks reversed course and moved higher over the next 12 months in nine of those instances,” according to a Bloomberg report.

Historically, the day-after election movements in the S&P 500 in particular are not a reliable signal of what’s ahead.

“While the index swings an average 1.5 percent the day after the vote,” it said, “gains or losses over the first 24 hours predict the market’s direction 12 months later less than half the time.”

In addition to a jump in stocks, the price of oil and the U.S. dollar increased. Gold was selling off. Two oil benchmarks were up in price Monday: North Sea Brent was up 1.29 percent to $46.17. West Texas Intermediate had risen $44.81 for December deliveries, according to the Wall Street Journal.

“Market volatility is no reason to panic,” Farr said. “It is a part of investing. If one doesn’t have the time frame to endure downturns, one should sell. Otherwise, all investors should always be prepared for unpleasantness along the road.”

Featured Image: CNBC

(c) 2016, The Washington Post · Thomas Heath